PalawanPay ProtekPadala—your shield against online fraud

In today’s fast-paced digital world, online banking and financial transactions have made life more convenient and exposed users to risks like fraud and identity theft. According to a recent survey by the Cybercrime Investigation and Coordinating Center, over one-third of Filipinos have experienced online scams or retail fraud.

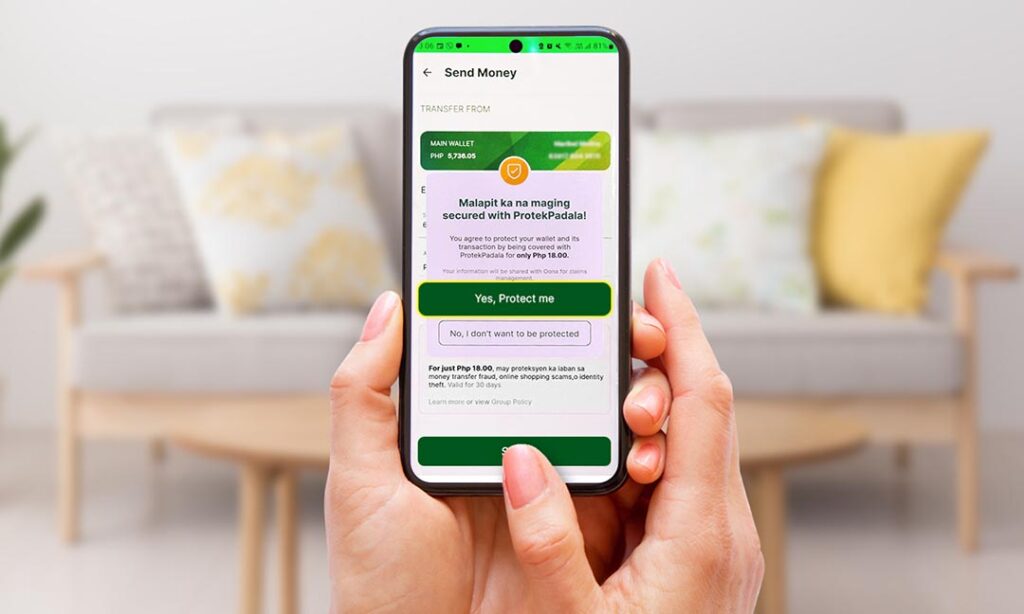

To address these challenges, the Palawan Group of Companies—a trusted leader in pawnshops and remittance services—introduces ProtekPadala, an innovative feature of PalawanPay designed to protect users from fraud and unlawful online activities.

As one of the fastest-growing e-wallet apps in the Philippines, PalawanPay already offers a secure platform for sending and receiving money, paying bills, and shopping online. With ProtekPadala, it takes user safety to the next level by adding a vital layer of protection to every transaction, ensuring your funds remain secure at all times. Whether transferring money between PalawanPay wallets, sending funds to Palawan Express Pera Padala, other e-wallets, or banks, making merchant payments, or sending e-gifts, ProtekPadala ensures every transaction is safe and secure. This feature reflects the Palawan Group’s unwavering commitment to protecting Filipinos’ hard-earned money.

“For just Php18, your PalawanPay account and all send money transactions will be protected for 30 days with ProtekPadala. This protection is part of our commitment to providing our “sukis” with “mura, mabilis, at walang kuskos balungos na serbisyo” (affordable, fast, and hassle-free service), making every transaction secure and worry-free,” Palawan Group of Companies’ cash management solutions director Lisa Lou Castro-Sabado said.

ProtekPadala protects you from common online threats, including:

Electronic Funds Transfer Fraud: Covers losses from unauthorized transfers from your PalawanPay account.

Online Shopping Fraud: Guards you against online purchases where the seller misleads the customers and fails to deliver the goods after payment.

Identity Theft: Shields you if your personal information is stolen and used for fraudulent activities.

There is a P10,000 automatic coverage upon enrollment in ProtekPadala. Users can enroll in ProtekPadala up to 10 times within a 30-day period, increasing their coverage to a maximum of Php 100,000 for added security. ProtekPadala insurance is made possible through Oona Insular Insurance Corporation, ensuring reliable and trustworthy protection.

“At Oona, we understand that financial security is the foundation of trust in today’s digital age. We are excited about our partnership with PalawanPay, as we share a common vision of ensuring secure and seamless digital financial services. With ProtekPadala, we aim to protect users from online threats, empowering them to confidently engage with digital transactions and embrace financial services with peace of mind.” said Abhishek Bhatia, founder and group CEO of Oona Insurance.

With PalawanPay, you’re not just sending money—you’re sending peace of mind. Backed by the Palawan Group’s nearly 40 years of experience, ProtekPadala ensures your transactions are safeguarded against fraud and online threats. Enjoy 24/7 customer support, accessible assistance at over 3,500 branches, and the confidence that your hard-earned money is always protected. Choose PalawanPay’s ProtekPadala and experience financial peace of mind like never before.

For more information on how to enroll in ProtekPadala, check your PalawanPay app or visit PalawanPay app website. Palawan Group of Companies is supervised by the Bangko Sentral ng Pilipinas.